POLICY & REGULATION

Financial Services Sector’s Stability Maintained Amidst Global Geopolitical Dynamics

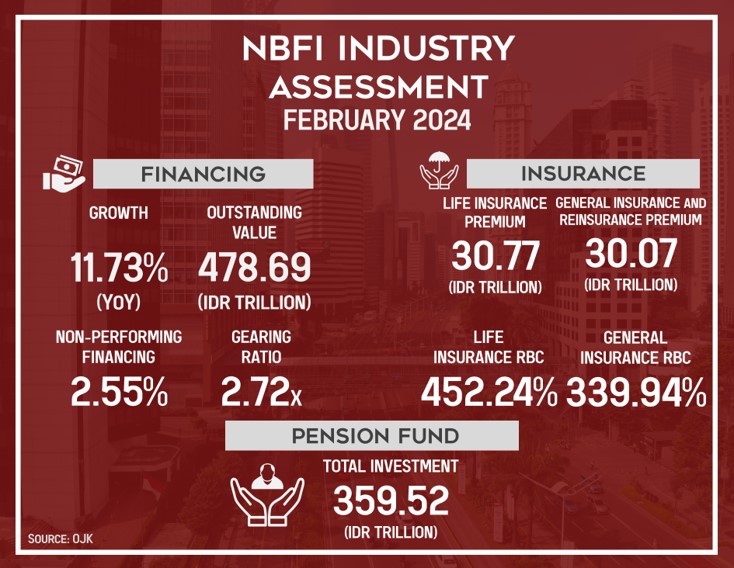

Jakarta, 13 May 2024. The Board of Commissioners Monthly Meeting (RDKB) of OJK on 2 May 2024 assessed that the national financial services sector remains stable with the financial intermediation performance being one of its contributors.

The End of the Covid-19 Banking Credit Restructuring Stimulus

Otoritas Jasa Keuangan/OJK (The Indonesia Financial Services Authority) announced that the banking credit restructuring stimulus policy for the impact of Covid-19 ends on March 31, 2024. The end of this policy is consistent with the government's revocation of the Covid-19 pandemic status in June 2023 and considers the recovery of the Indonesian economy from the impact of the pandemic, including the condition of the real sector.

Implementation of Anti-Money Laundering (AML), Countering Terrorism Financing (CTF), and Countering the Proliferation Financing (CPF) of Weapons of Mass Destruction Program in the Financial Services Sector

The OJK Regulation Number 8 of 2023 is issued to strengthen the prevention of money laundering, terrorism financing, and proliferation financing of weapons of mass destruction and to realize integrity in the financial services sector.

NEWS & PUBLICATION

The Quarterly Report on Indonesia Financial Sector Development: Q1 2024

The Investor Relations Unit of the Indonesia Financial Services Authority (OJK IRU) releases the Quarterly Report on Indonesia’s Financial Sector Development to offer general insights into the global and Indonesian economies, as well as the development of the financial services sector.

Financial Services Sector Remain Stable and Supported by Robust Intermediation Performance

The financial services sector remains stable, supported by strong capitalization and adequate liquidity amidst global uncertainties due to heightened geopolitical tensions, the potential for an expanding trade war, and global economic performance that remain below expectations.