POLICY & REGULATION

OJK Launches the 2024-2028 Roadmap for the Development and Strengthening of the Financial Sector Technology Innovation, Digital Financial Assets, and Crypto Assets (IAKD)

The Indonesia Financial Services Authority (OJK) launched the 2024-2028 Roadmap for the Development and Strengthening of Financial Sector Technology Innovation, Digital Financial Assets, and Crypto Assets (IAKD). This Roadmap builds upon the foundation set by the 2020-2024 Digital Finance Innovation Roadmap and Action Plan.

OJK Issues New Regulation on Debtor Reporting and Information Requests Through the Financial Information Service System (SLIK)

Jakarta, 8 August 2024, The Indonesia Financial Services Authority (OJK) issued Regulation Number 11 of 2024 concerning the Second Amendment to OJK Regulation (POJK) Number 18/POJK.03/2017 on Debtor Reporting and Information Requests through the Financial Information Service System (SLIK). This regulation aims to strengthen and develop the financial services sector and financial market infrastructure.

Financial System Stability Remains Maintained Amid Continuing Geopolitical Dynamics and Global Economic Uncertainty (KSSK Meeting on August 2024)

Jakarta, 2 August 2024. The Financial System Stability (SSK) in the second quarter of 2024 remains maintained amid increased pressures in the global financial markets due to ongoing global economic uncertainty and high geopolitical risks.

NEWS & PUBLICATION

OJK Consistently Supports Efforts to Eradicate Online Gambling Activities

Jakarta, 2 August 2024. Dian Ediana Rae, Chief Executive of Banking Supervision of the Indonesia Financial Services Authority (OJK), emphasized that OJK consistently undertakes various efforts within its authority to combat online gambling.

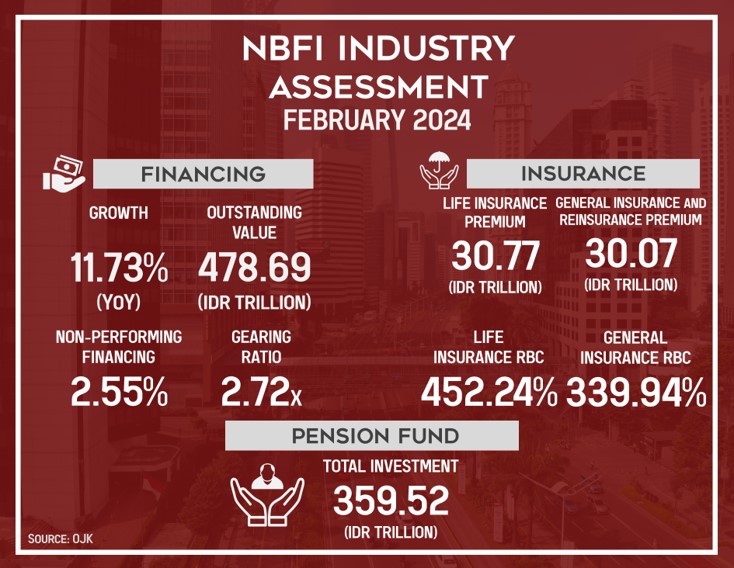

Financial Services Sector Remains Stable Amid High Global Economic Uncertainty

The financial services remains stable and contributive to national growth, supported by a high level of solvency and a manageable risk profile amidst still high global uncertainty.