STRUCTURAL REINFORCEMENT OF THE NATIONAL BANKING SYSTEM PROGRAM

"Creation of a robust structure for the domestic banking system capable of meeting the needs of the public and promoting sustainable economic development."

This program is aimed at building stronger capitalization into commercial banks (conventional and sharia) as part of the strengthening of bank capacity for business and risk management, development of information technology, and expansion of business scale in order to support increased capacity for bank credit expansion. The program for reinforced capitalization of commercial banks will be implemented in stages.

Measures to increase commercial bank capital will be put into place in well developed business plans containing deadlines, methods, and stages of progress. Capital may be increased by any of the following means:

- addition of fresh capital from existing shareholders or new investors;

- merger with another bank (or several banks) or an anchor bank to meet the new minimum capital requirement; and/or

- issue of new shares or secondary offering on the capital market.

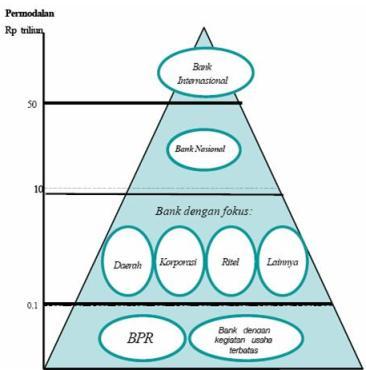

The program for improvement of overall capitalization of commercial banks is expected to produce a more optimum structure for the banking system within the next ten to fifteen years. This structure is envisaged as follows:

- two or three banks with potential to emerge as international banks, possessing the capacity and ability to operate with an international presence and having total capital exceeding Rp 50 trillion;

- 3 to 5 national banks, having a broad scope of business and operating nationwide with total capital of between Rp 10 trillion and Rp 50 trillion;

- 30 to 50 banks operating as focused players, operating in particular business segments according to the capability and competence of each bank. These banks will have capital of Rp 100 billion up to Rp 10 trillion;

- rural banks (BPRs) and banks with limited scope of business, having capital of less than Rp 100 billion.

The structure envisaged for the Indonesian banking system in the next ten to fifteen years is depicted as follows:

:: Phase of Implementation

| No | Activity (Pillar I) | Implementation Schedule |

|---|

| 1. | Improvement of bank capital | |

| 1. Increase the minimum core capital requirement of conventional and sharia banks (including BPD) to Rp 80 billion | 2007 |

| 2. Increase the minimum core capital requirement of conventional and sharia banks (including BPD) to Rp 100 billion | 2010 |

| 3. Maintain minimum paid up capital requirement of Rp 3 trillion for establishment of a conventional bank until 1 January 2011 | 2004 – 2010 |

| 4. Set the minimum paid up capital requirement at Rp 1 trillion for establishment of sharia banks | 2005 |

| 5. Set the capital requirement at Rp 500 billion for sharia banks that are a spin off of a Sharia Business Unit | 2006 |

| 6. Shorten the deadline for Rural Bank compliance with the minimum paid up capital requirement from 2010 to 2008 | 2008 |

| 2. | Building the competitiveness and institutionalization of Rural Banks and Sharia Rural Banks | |

| 1. Strengthen the linkage program between conventional banks and Rural Banks | 2007 |

| 2. Implement the strategic alliance program of sharia financial institutions and Sharia Rural Banks through strategic partnership for the development of UMKM | 2007 |

| 3. Promote the establishment of Rural Banks and Sharia Rural Banks outside of Java and Bali | 2006 – 2007 |

| 4. Facilitate the opening of Rural Banks and Sharia Rural Banks branch offices for those that fulfill the criteria | 2004 – 2006 |

| 5. Expedite the formation of joint service facilities for Rural Banks and Sharia Rural Banks (including APEX Institutions) | 2006 – 2007 |

| 3. | Improving UMKM access to credit and financing | |

| 1. Facilitate the formation and monitoring of credit and financing guarantee scheme | 2004 – 2007 |

| 2. Encourage banks to increase financing of UMKM, particularly for low-income and village inhabitants | 2004 – 2009 |

| 3. Increase access to sharia financing for UMKM through development of guarantee programs for sharia financing | 2010 |

| 4. Encourage sharia banks to increase the percentage of profit-sharing based financing | 2010 |