I. Legal Basis of Market Conduct Supervision, Education, and Financial Consumer Protection Sector

The sector of Market Conduct Supervision, Education, and Financial Consumer Protection is governed by Law Number 4 of 2023 on Financial Sector Development and Strengthening, as outlined below:

Article 1 number 41

Market Conduct Supervision is supervision of the behavior of Financial Sector Business Actors/Pelaku Usaha Sektor Keuangan (PUSK) in designing, providing and disseminating information, offering, drafting agreements, providing services for the use of products and/or services, as well as handling complaints and resolving disputes in an effort to realize Consumer Protection.

Article 8 number 3

In order to achieve the objectives of the Financial Services Authority as referred to in Article 4, the Financial Services Authority functions to:

- organize an integrated regulatory and supervisory system for all activities in the financial services sector;

- actively maintain Financial System Stability in accordance with its authority; and

- provide protection to consumers and society.

Article 8 number 4

(1) The Financial Services Authority performs regulatory and supervisory tasks on:

a. financial service activities in the Banking sector;

b. financial service activities in the Capital Markets, Derivatives finance, and carbon stock exchange sectors;

c. financial service activities in the Insurance, Underwriting and Pension Fund sectors;

d. financial service activities in the sector of Financing Institutions, venture capital companies, microfinance institutions, and Other FSI;

(2) In addition to the tasks as referred to in Sub-Article (1), the Financial Services Authority is tasked with carrying out financial sector development, coordinating with relevant ministries/institutions and authorities.

Article 8 number 7

- The composition of the Board of Commissioners as referred to in Sub-Article (3) consists of:

a. Chairperson, concurrently as member;

b. a Vice Chairperson functioning as the Head of Ethics Committee, concurrently as member;

c. a Chief Executive functioning as Banking Supervisor, concurrently as member;

d. a Chief Executive functioning as Capital Market Supervisor, concurrently as member;

e. a Chief Executive functioning as Insurance, Guarantee and Pension Funds Supervisor concurrently as member;

f. a Chief Executive functioning as Financial Institutions, Venture Capital, Microfinance Institutions, and Other Financial Service Institutions Supervisor, concurrently as member;

g. a Chief Executive functioning as Financial Sector Technology Innovation, Digital Financial Assets and Crypto Assets Supervisor, concurrently as member;

h. a Chief Executive functioning as Conduct of Financial Services Business Actors, Education and Consumer Protection Supervisor, concurrently as member;

i. a Head of Board of Auditors, concurrently as member; and

j. an Ex-officio member from Bank Indonesia who is a member of the Board of Governors of Bank Indonesia; and

k. an Ex-officio member from the Ministry of Finance who is an echelon I level official of the Ministry of Finance.

Article 234

- The financial sector authority shall carry out the Market Conduct Supervision to ensure the compliance of PUSK in implementing the provisions of Consumer Protection, directly and/or indirectly, according to the function, duties, and authorities of the financial sector authority given based on the Law.

- Further provisions regarding supervision as referred to in Sub-Article (1) is stipulated in the regulation of the financial sector authority in accordance to their respective authorities.

Article 229

Consumer Protection in the financial sector is implemented with the objectives of:

- creating a Consumer Protection ecosystem that realizes legal certainty and effective and efficient complaint handling and dispute resolution;

- raising awareness of PUSK on responsible business conduct, fair treatment; protection to consumer asset, privacy, and data; and increasing the quality of products and/or services of PUSK; and

- increasing awareness, ability, and independence of the consumers regarding products and/or services of PUSK and increasing consumer empowerment.

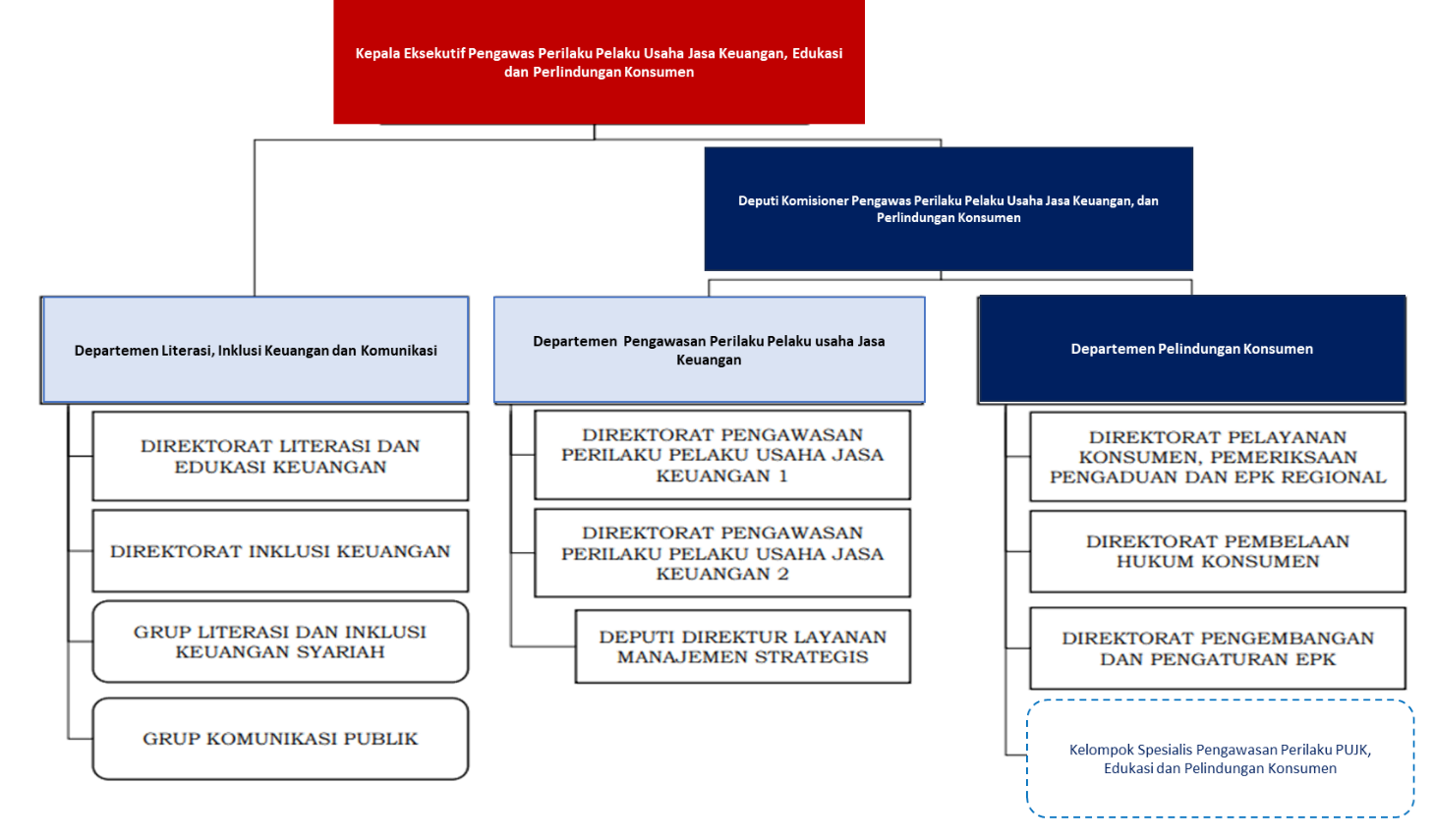

II. Organization Structure of Market Conduct Supervision, Education, and Financial Consumer Protection Sector

III. Scopes of Market Conduct Supervision based on The Product's Life Cycle

IV. Issues Related to Consumer Protection in The Financial Service Sector

- Misleading / mis-selling of financial products and services

- Non-transparent and inconsistent fees with agreements

- Unclear, inaccurate, dishonest, and potentially deceptive product and service information

- Fraud cases committed by employees and/or affiliate parties of financial service providers

- Unethical debt collection practices

- Data breaches and consumer personal information leaks

- Insufficient provision of facilities for disabled and elderly consumers

- Inclusion of exoneration/exemption clauses in agreements that do not comply with legal provisions

- Inadequate internal dispute resolution mechanisms or handling and settlement of complaints within financial service providers, and external dispute resolution mechanisms or handling and settlement of complaints outside of financial service providers.

V. Instruments for Market Conduct Supervision by OJK

1. Direct Supervisiona. Thematic Inspection

A Thematic Inspection is a form of market conduct supervision done by conducting a series of activities to collect and process data, information, and/or analysis on financial products and/or services that have the potential to cause harm to consumers based on a predetermined theme.

Examples of themes in Thematic Inspection include:

- Standardized agreements;

- Consumer complaint handling mechanism;

- Collateral withdrawal mechanisms.

b. Specialized Inspection

Specialized Inspection is a form of market conduct supervision done by conducting a series of activities to collect and process data, information, and/or evidence to prove the suspicion of behavior by a Financial Services Provider that violates regulations in the financial services sector and/or causes harm to consumers.

The Special Inspection is carried out, among other things, through verification and investigation of complaints. Specific aspects include certain activities or business operations, indications of deviations by the Financial Services Provider, and the resolution of complaints. Indications of deviations by the Financial Services Provider also include those conveyed through consumer complaints.

2. Indirect Supervision

a. Analysis of information and reports received by OJK conducted on:

- Self-assessment reports from Financial Services Providers on compliance with consumer and public protection regulations;

- Information from the integrated consumer and public service system in the financial services sector; and/or

- Monitoring of financial services advertisements.

b. Field Observation

Field Observation is an indirect Market Conduct Supervision in the form of the collection and analysis of information regarding the interaction between the Financial Services Providers and their consumers, with the aim of identifying issues related to the implementation of consumer protection.

Field Observation is carried out through the following methods:

a. Survey of Market Conduct Supervision; and/or

b. Market Intelligence Operations.

Here are the techniques used in Field Observation through market intelligence operations:

- Open Source Intelligent

- Mystery Calling

- Mystery Shopping

- Customer Testimony

- In-Depth Interview

3. Differences Between Thematic Inspection and Specialized Inspection| Thematic Inspection | Specialized Inspection |

- The implementation is based on the plan prepared at the beginning of the inspection period.

- The inspection is conducted based on a specific theme targeting the entire inspection object.

- It is carried out by a thematic inspection team.

- The examination aims to assess the Financial Services Provider's compliance with OJK regulations.

- The results of the examination include recommendations for improvement.

- Follow-up actions may include administrative sanctions.

| - The implementation is not dependent on a specific time (can be conducted at any time).

- The implementation is also based on the results of direct supervision, indirect supervision, or requests (case by case).

- It is carried out by a special inspection team, which is different from the thematic inspection team.

- The purpose of the examination is to deepen findings and strengthen evidence of violations.

- The results of the examination are in the form of a report containing proof of the violations that occurred.

- Follow-up actions may include administrative or criminal sanctions (referral to the investigative unit).

|