SP-01/KO.01/2025

PRESS RELEASE – RDKB DECEMBER 2024

DEVELOPMENT AND STRENGTHENING OF THE FINANCIAL SERVICES SECTOR

EAST JAVA PROVINCE

Surabaya, January 20, 2025. The financial services sector is one of the components contributing to the Regional Gross Domestic Product. As the regulator of the financial services sector, the OJK consistently strives to ensure that all activities within the sector are conducted in an orderly, fair, transparent, and accountable. Consequently, it is expected that the financial services sector will remain stable, thereby playing its role and providing maximum contribution to the economy.

The East Java Provincial OJK Office (OJK KOSB) assesses that the stability of the Financial Services Industry (FSI) in East Java remains intact, influenced by several factors including a contributive intermediation performance, adequate liquidity, and strong capitalization levels. Domestic economic performance continues to remain stable, with headline inflation decreasing to 1.55%.

Capital Market Performance

Amidst financial market volatility, capital outflow pressure due to currency depreciation, the Federal Reserve's interest rate cuts, and global geopolitical tensions causing economic uncertainty, the capital market continues to show positive trends.

Amidst financial market volatility, capital outflow pressure due to currency depreciation, the Federal Reserve's interest rate cuts, and global geopolitical tensions causing economic uncertainty, the capital market continues to show positive trends.

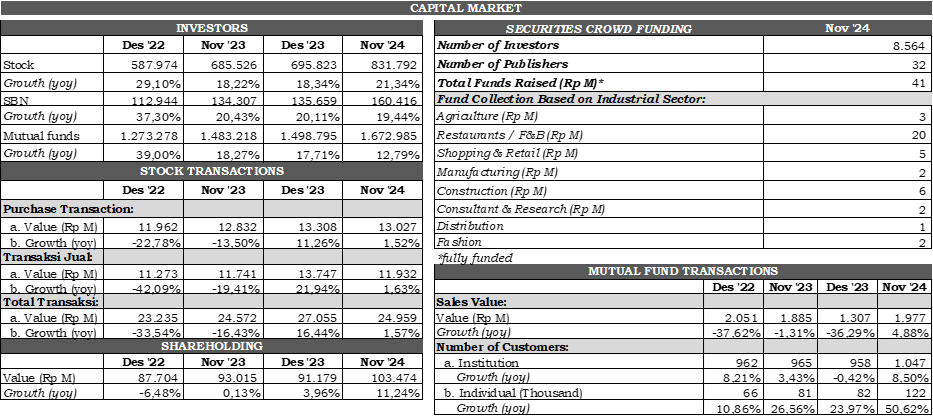

As of November 2024, the number of Single Investor Identification (SID) for Stocks increased to 831,792 SID, growing by 21.34% (yoy); SID for Government Securities (SBN) rose to 160,416 SID, growing by 19.44% (yoy); and SID for Mutual Funds increased to 1,672,982 SID, recording 12.79% (yoy) growth.

As of November 2024, stock transaction value in East Java reached Rp24.95 trillion, marking an increase of 1.57% compared to the same period last year. This reflects sustained stock trading activity despite financial market dynamics. Additionally, total stock ownership value reached Rp103.47 trillion, a significant increase of 11.24% (yoy),

indicating strong investor confidence in East Java's capital market. This growth signals optimism regarding economic potential and corporate performance in the capital market, while also reflecting the effectiveness of financial literacy and inclusion efforts in attracting public investment interest in East Java.

In the investment management industry, mutual fund sales value reached Rp1.90 trillion as of November 2024, reflecting 4.88% growth compared to the previous year. This increase was accompanied by a 8.50% rise in institutional investors and a significant 50.62% surge in individual investors, demonstrating growing interest in portfolio-based investments among both individuals and institutions.

Meanwhile, fundraising through Securities Crowdfunding (SCF), which serves as an alternative financing option for MSMEs, saw 32 issuers, 8,564 investors, and total funds raised amounting to Rp41.00 billion in East Java as of November 2024.

Banking Industry Performance

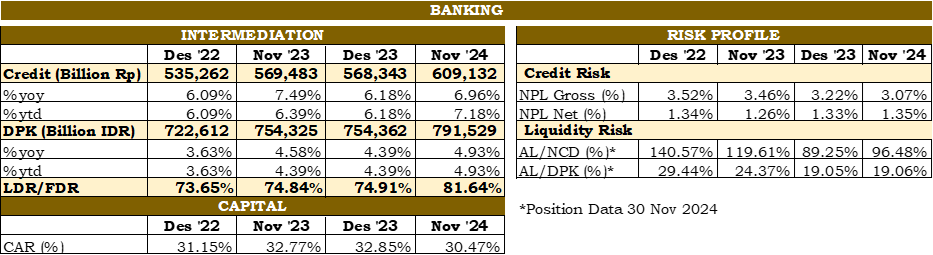

As of November 2024, banking credit grew by 6.96% (yoy) to Rp609.13 trillion. Meanwhile, Third-Party Funds (DPK) grew annually by 4.93% (yoy), reaching Rp791.52 trillion. As a result, the Loan-to-Deposit Ratio (LDR) in East Java stood at 81.64% in November 2024.

As of November 2024, banking credit grew by 6.96% (yoy) to Rp609.13 trillion. Meanwhile, Third-Party Funds (DPK) grew annually by 4.93% (yoy), reaching Rp791.52 trillion. As a result, the Loan-to-Deposit Ratio (LDR) in East Java stood at 81.64% in November 2024.

OJK continues to encourage financial institutions (IJK) to support East Java's economy by promoting financial intermediation while maintaining banking performance to balance credit growth and liquidity management. As of November 2024, the banking industry liquidity remains adequate, with Liquidity/Non-Core Deposit (AL/NCD) and Liquidity/Third-Party Funds (AL/DPK) ratios at 96.48% and 19.06%, respectively, both well above their respective thresholds of 50.00% and 10.00%.

Meanwhile, credit quality remains stable, with a net NPL (Non-Performing Loan) ratio of 1.35% and a gross NPL ratio of 3.07%, reflecting ongoing recovery in the real sector, particularly in MSMEs (Micro, Small, and Medium Enterprises).

Furthermore, banks in East Java remain confident that banking risks in Q4 2024 are well-managed, as reflected in the Investment Policy Ratio (IPR) Risk Perception Index of 55, indicating a manageable risk level. This confidence is supported by stable credit and market risk conditions and credit quality that remains strong. Additionally, profitability is expected to improve alongside credit disbursement growth and a gradual decline in the cost of funds, while liquidity risks remain stable.

Overall, credit growth, increased Third-Party Funds (TPF), and stable risk management indicate that the banking sector is in a strong position to support regional economic growth. This serves as a positive indicator that banks can adapt to challenging economic conditions and continue to contribute to economic recovery, particularly in East Java.

Performance of the Insurance, Guarantee, and Pension Fund Industry

The Insurance, Guarantee, and Pension Fund (PPDP) sector has shown positive trends, supporting economic growth while providing better financial protection for the public. The life and general insurance industries recorded significant growth.

The Insurance, Guarantee, and Pension Fund (PPDP) sector has shown positive trends, supporting economic growth while providing better financial protection for the public. The life and general insurance industries recorded significant growth.

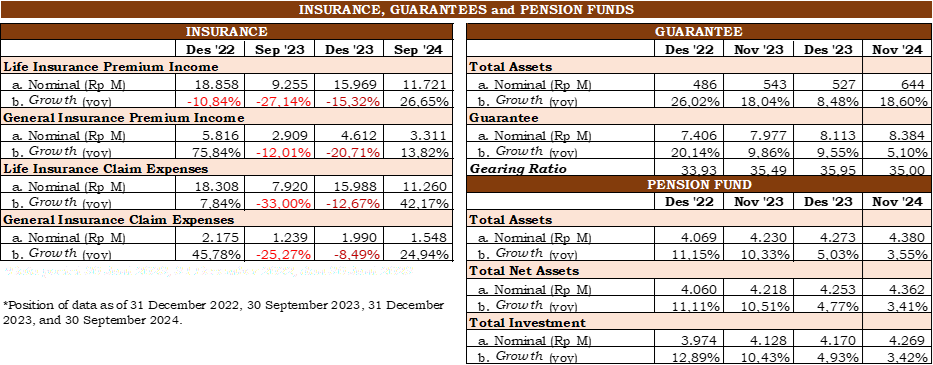

As of September 2024, the accumulated life insurance premium revenue reached Rp11.72 trillion, reflecting a 26.65% year-on-year (yoy) increase. This growth indicates a rising awareness among East Java's population about the importance of life protection and the success of insurance companies in expanding their market through innovative products tailored to public needs.

Meanwhile, general insurance premium revenue also grew by 13.82% yoy, reaching Rp3.31 trillion. This increase reflects higher demand for asset protection and risk mitigation, driven by post-pandemic economic recovery and revitalized business activities.

In the pension fund industry, total assets as of November 2024 grew by 3.55% yoy, reaching Rp4.38 trillion, up from Rp4.23 trillion in November 2023. This increase aligns with investment growth of 3.42% yoy, with a total value of Rp4.26 trillion, compared to Rp4.12 trillion in the same period the previous year. This trend highlights the pension fund sector's ability to manage its investment portfolio optimally, despite global challenges.

In the guarantee sector, the total assets of guarantee companies grew by 18.60% yoy, reaching Rp644 billion in November 2024, up from Rp543 billion in November 2023. This asset growth reflects the enhanced financial capacity of guarantee companies, allowing them to support a broader scope of guarantee activities.

However, the total guarantee value recorded a decline of 5.10% yoy, decreasing from Rp8.38 trillion in November 2023 to Rp7.97 trillion in November 2024.

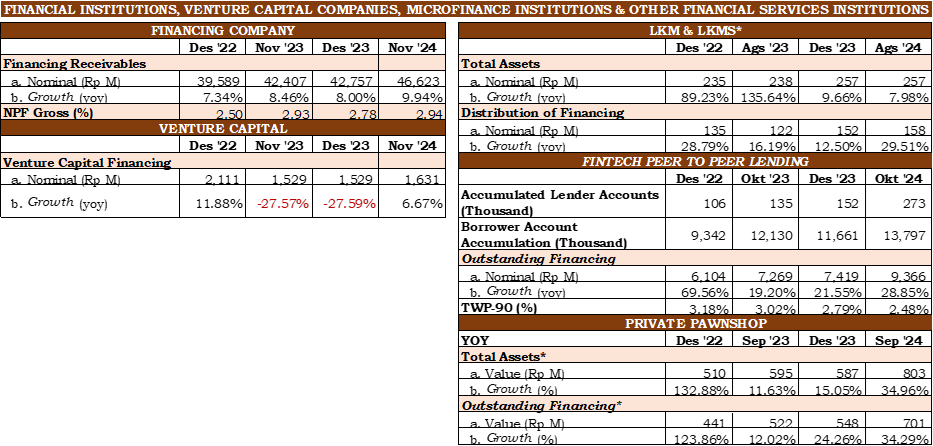

Performance of the Financing, Venture Capital, Microfinance, and Other Financial Services Sector

Various indicators in the Financing, Venture Capital, and Microfinance Services (PVML) sector showed dynamic trends in November 2024. Accounts receivable from Financing Companies (PP) grew by 9.94% year-on-year (yoy), reaching Rp46.62 trillion. This growth reflects high demand for financing, both in the consumer and productive sectors, as part of the post-pandemic economic recovery. Additionally, the risk profile in the financing sector remains healthy, with the gross Non-Performing Financing (NPF) ratio remaining stable at 2.94%, well below the acceptable threshold, demonstrating effective risk management by industry players.

Various indicators in the Financing, Venture Capital, and Microfinance Services (PVML) sector showed dynamic trends in November 2024. Accounts receivable from Financing Companies (PP) grew by 9.94% year-on-year (yoy), reaching Rp46.62 trillion. This growth reflects high demand for financing, both in the consumer and productive sectors, as part of the post-pandemic economic recovery. Additionally, the risk profile in the financing sector remains healthy, with the gross Non-Performing Financing (NPF) ratio remaining stable at 2.94%, well below the acceptable threshold, demonstrating effective risk management by industry players.

On the other hand, the Venture Capital sector faced challenges, experiencing a 6.67% yoy contraction in November 2024, although this was an improvement compared to the sharp decline of -27.59% yoy in December 2023. The total venture capital financing stood at Rp1.63 trillion, up from Rp1.52 trillion in December 2023.

In the Fintech Peer-to-Peer (P2P) Lending sector, outstanding financing growth recorded impressive performance, increasing by 28.85% yoy in October 2024, reaching Rp9.36 trillion. This continued the positive trend from December 2023, when it grew by 21.55% yoy. The default risk (TWP-90) also remained well-managed at 2.48%, down from 2.79% in December 2023.

Meanwhile, total assets of private pawnshops showed significant growth, increasing by 34.96% yoy in September 2024, reaching Rp803 billion, compared to Rp595 billion in September 2023. This growth indicates rising public trust in pawnshop institutions as an alternative for quick and easy financing, particularly for emergency needs or micro-financing. The flexible nature of pawnshop services, which cater to the lower-middle-income segment, has been a key factor driving this increase.

Financial Services Conduct Supervision, Education, and Consumer Protection

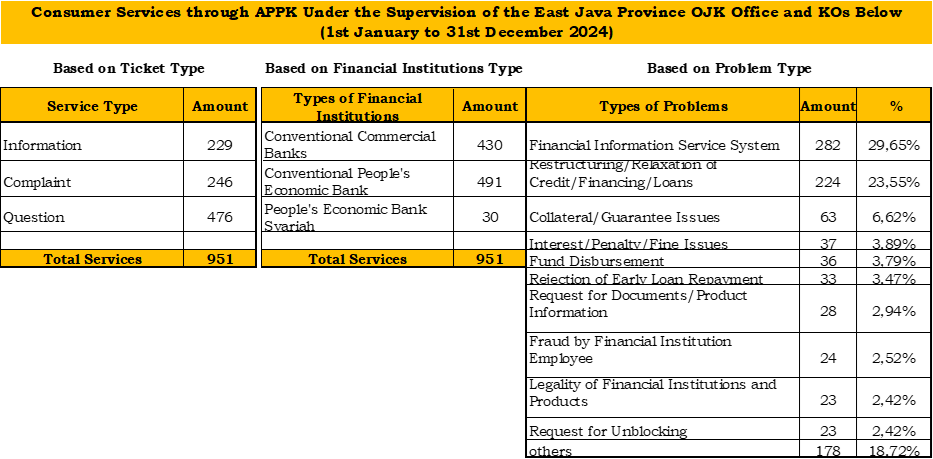

From January to December 31, 2024, based on complaints data from the Consumer Protection Portal Application (APPK), which serves Financial Services Providers (PUJK) headquartered in the OJK Regional Office of East Java and its subordinate offices, a total of 951 complaints were recorded. These were categorized as follows: 229 complaints related to information requests, 246 consumer complaints, 476 inquiries and information submissions. By PUJK category, the breakdown of complaints is as follows:

From January to December 31, 2024, based on complaints data from the Consumer Protection Portal Application (APPK), which serves Financial Services Providers (PUJK) headquartered in the OJK Regional Office of East Java and its subordinate offices, a total of 951 complaints were recorded. These were categorized as follows: 229 complaints related to information requests, 246 consumer complaints, 476 inquiries and information submissions. By PUJK category, the breakdown of complaints is as follows:

- Conventional Commercial Banks: 430 complaints

- Conventional Rural Banks (BPR): 491 complaints

- Sharia Rural Banks (BPRS): 30 complaints

Regarding the types of issues reported, the most common categories were:

- Financial Information Services System (SLIK): 29.65%

- Credit/Financing Restructuring and Relaxation: 23.55%

- Collateral/Guarantee Issues: 6.62%

- Interest/Fines/Penalty Issues: 3.89%

To address consumer protection issues and promote financial literacy and inclusion, OJK continues to implement extensive literacy and inclusion programs, both offline (face-to-face) and online through social media and digital platforms. OJK has also been active on social media (Instagram @OJK_Jatim; @OJK_Malang; @OJK_Kediri; @OJK_Jember) as an official communication channel for financial education. As of 2024, OJK has published 1,914 educational posts, attracting 32,678 followers and 339,000 viewers.

Financial Literacy and Inclusion Initiatives

The Regional Financial Access Acceleration Team (“Tim Percepatan Akses Keuangan Daerah"-TPAKD) has been established in all districts in East Java, totaling 39 TPAKDs, consisting of 1 provincial-level TPAKD and 38 district/city-level TPAKDs.

Throughout 2024, OJK in East Java conducted 439 financial education activities, reaching 159,149 participants from various sectors, including students, university students, MSME entrepreneurs, and women.

To boost financial literacy and inclusion nationwide, OJK and the National Inclusive Finance Council (DNKI) launched the National Smart Finance Movement (Gerakan Nasional Cerdas Keuangan-GENCARKAN) on August 22, 2024, under the theme "Financially Smart Society Towards Indonesia Emas 2024". This initiative aims to orchestrate a nationwide movement to enhance financial literacy and inclusion, supporting economic growth and improving public welfare.

Between August and October 2024, the GENCARKAN program in East Java recorded 241 activities, reaching 63,000 participants. The program was implemented through literacy and inclusion efforts by Financial Services Providers (PUJK), including branch offices and networks, with monitoring and coordination by OJK regional offices.

To further improve financial literacy and inclusion indices, OJK introduced the Inclusive Financial Ecosystem (EKI) program in rural areas and the Inclusive Islamic Boarding School Financial Ecosystem (EPIKS) initiative. In 2024, OJK implemented the EKI program in six villages: Dolokgede Village, Bojonegoro Regency ; Bejijong Village, Mojokerto Regency; Krenceng & Kemloko Villages, Blitar Regency; Peger Kulon Village, Jember Regency; Gubug Klakah Tourism Village, Malang Regency. Additionally, the EPIKS program was implemented in two Islamic boarding schools (pesantren): Darul Ulum Islamic Boarding School, Peterongan; Bahrul Ulum Islamic Boarding School, Tambakberas, Jombang Regency.

Through these programs, OJK provided financial education and awareness campaigns, enabling rural communities and pesantren residents to gain confidence in utilizing financial products and services.

Regional Economic Development (RED) Program

For Regional Economic Development (RED) initiatives, in 2024, the RED program initiated by KOSB focused on agriculture development, specifically melon farming using greenhouses in Lamongan Regency.

The RED program is implemented through the "TUNAS" (“perTanian Unggul, berkelaNjutan, dan berdayA Saing"- Sustainable and Competitive Superior Agriculture) scheme, which involves: Local Government (through relevant agencies), Banks and Financial Institutions, Insurance and Guarantee Providers, Farmers and Agribusiness Entrepreneurs, Business Consultants

This initiative aims to enhance business capacity and improve farmers' welfare, particularly melon farmers in Lamongan, while contributing to regional economic growth.

For further information:

Head of OJK East Java Province

Tel: (031) 992 10100