A. Sandbox

The Trial/Innovation Development Space, hereinafter referred to as the Sandbox, is a facility and mechanism provided by the Financial Services Authority (OJK) to facilitate the testing and development of innovations. It is designed to assess the feasibility and reliability of Financial Sector Technology Innovation (FSTI). The Sandbox aims to ensure that innovation and technological development in the financial sector are conducted responsibly with proper risk management.

Sandbox participants are Financial Services Institutions (FSI) or Non-FSI that have received approval from the OJK to participate in the Regulatory Sandbox

OJK's authority in organizing the Sandbox is regulated in Financial Services Authority Regulation Number 13/POJK.02/2018 dated August 15, 2018 (POJK IKD) concerning Digital Financial Innovation in the Financial Services Sector which is updated and replaced by Financial Services Authority Regulation Number 3 in 2024 dated February 16, 2024 concerning the Implementation of Financial Sector Technological Innovation (POJK FSTI).

As a follow-up to the POJK FSTI related to the implementation of the Regulatory Sandbox, in the second quarter of 2024 the OJK issued the Financial Services Authority Circular Letter Number 5 of 2024 concerning the Mechanism of the Testing and Innovation Development Room (SEOJK Sandbox).

B. The Results of the Regulatory Sandbox for Sandbox Participants Based on POJK 13/POJK.02/2018

At the time the POJK FSTI was established, there were still Digital Financial Innovation Providers who were in the process of applying for recording and/or sandbox participants who were still in the implementation of the sandbox, which still referred to the POJK IKD. In this regard, Article 50 of POJK FSTI stipulates transitional provisions that govern that: Digital Financial Innovation Providers who are in the process of applying for listing and sandbox participants who are still in the implementation of the sandbox as regulated in the POJK IKD are given the status:

Recommended with the obligation to register or license a business to the OJK;

Recommended without the obligation to register or license a business to the OJK; or

Not recommended.

The processing of sandbox results with reference to the POJK IKD has been completely completed by the OJK in April 2024 with the results of the sandbox as follows:

There are 108 FSTI Providers which are grouped into 15 business model clusters;

Of the 108 FSTI Providers, as many as 36 Sandbox Participants received recommended status with the obligation to register or obtain business licenses to the OJK;

The 36 Sandbox participants are grouped into 2 types of business models that will be regulated and supervised by the OJK, namely the Innovative Credit Scoring (ICS) business model or Alternative Credit Rating (ACR) and the Financial Services Aggregation Operator business model (consisting of Aggregator, Financing Agent, Funding Agent, Wealth Tech business model).

More detailed information related to the determination of the results of the Regulatory Sandbox which refers to the POJK IKD is attached below.

Determination of Results Regulatory Sandbox.pdf

Determination of Results Regulatory Sandbox.pdf

Participants of the regulatory sandbox who are given results in the form of recommended status with the obligation to register or license a business to the OJK, are required to submit at least documents related to the following aspects:

institutions and governance;

business model;

information technology; and

Partnership.

Based on Article 50 of POJK FSTI, participants who are declared recommended with the obligation to register or have a business license to the OJK are required to submit an application for registration or business license to the OJK within the validity period of the letter of recommendation.

C. Implementation of the Sandbox Based on POJK Number 3 of 2024

Flow of the Regulatory Sandbox Mechanism Based on POJK Number 3 of 2024

.png)

The implementation of testing and innovation development within the Sandbox is conducted for a maximum period of 1 (one) year from the date of approval granted by OJK.

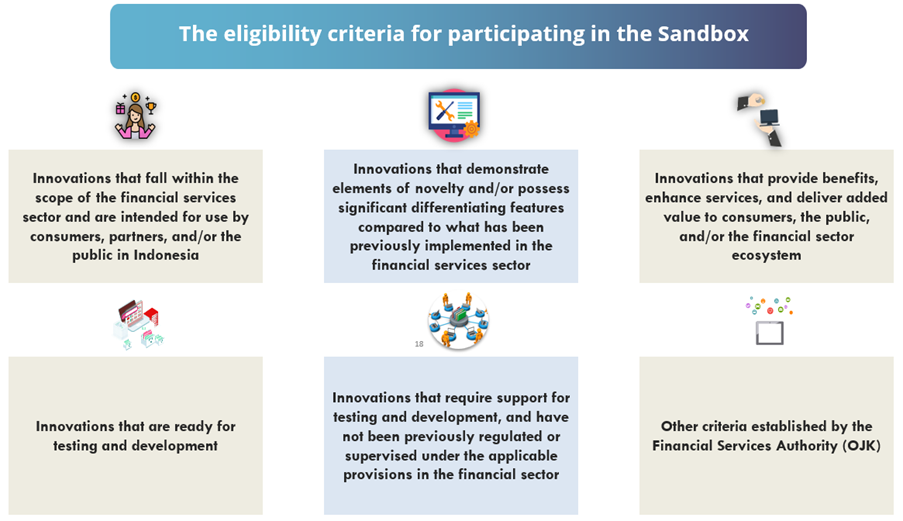

Eligibility Criteria for Innovations to Participate in the Sandbox

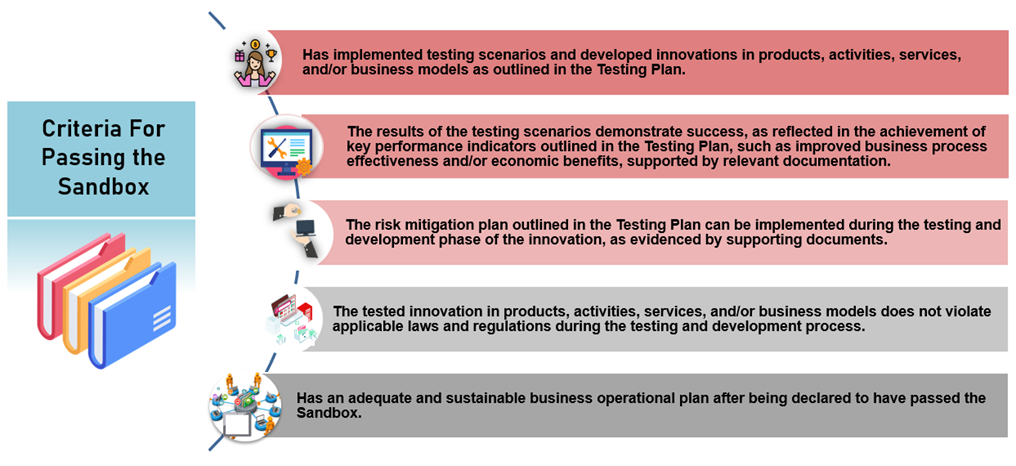

Criteria for Passing the Regulatory Sandbox Based on POJK Number 3 of 2024

Results of the Sandbox

OJK will declare the results of the Sandbox as follows:

a. Pass; or

b. Fail.

Participants who are declared to have passed must apply for a business license from OJK within the validity period of the pass letter, which is 6 (six) months and may be extended based on OJK's consideration. If the validity period of the pass letter expires and the participant has not applied for a business license, the participant is required to:

a. Cease the operational activities, product innovation, business activities, and services that use the business model tested and developed in the Sandbox;

b. Settle all obligations to consumers and other parties; and

c. Implement the exit policy outlined in the Testing Plan,

no later than 3 (three) months from the expiration of the pass letter.

Participants who are declared to have failed must:

a. Cease the operational activities, product innovation, business activities, and services that use the business model tested and developed in the Sandbox;

b. Settle all obligations to consumers and other parties; and

c. Implement the exit policy outlined in the Testing Plan,

no later than 3 (three) months from the date the failure letter is delivered by OJK.

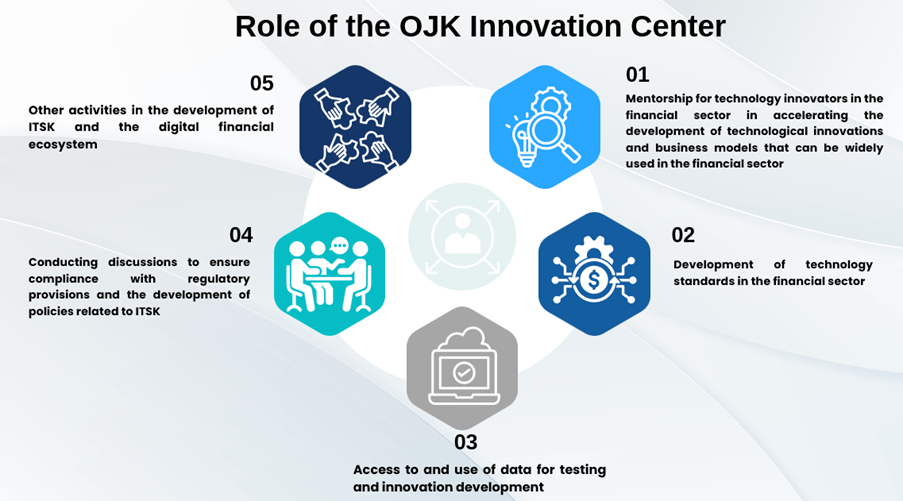

D. Innovation Center

OJK operates an Innovation Center as a platform for the development of innovations and guidance for all stakeholders in the digital financial ecosystem. The operation of the Innovation Center includes: