Financial Services Authority, Jakarta, August 11, 2016: The Financial Services Authority (OJK) continues its supervision on how complaints reported to the Consumer Education and Protection Reporting System (SIPEDULI) are handled, in order to monitor incoming complaints, and how they are processed and resolved by financial service companies (PUJKs) through their internal dispute resolution (IDR) units.

OJK-Improves-Handling-Complaints from-Indonesia-Financial-Consumers.pdf

OJK-Improves-Handling-Complaints from-Indonesia-Financial-Consumers.pdf OJK-Improves-Handling-Complaints from-Indonesia-Financial-Consumers.pdf

OJK-Improves-Handling-Complaints from-Indonesia-Financial-Consumers.pdf

"IDR units signify implementation of the POJK No. 1/2013 on Protection of Consumers in the Financial Services Sector. PUJKs respond to the regulation by setting up units and/or creating functions that deal with complaints and having service level agreements, so consumers feel they are well protected," Kusumaningtuti S. Soetiono, Member of the OJK's Board of Commissioners, Consumer Education and Protection Division, said at LAPS Workshop held at the Grand Hyatt Hotel on August 11, 2016.

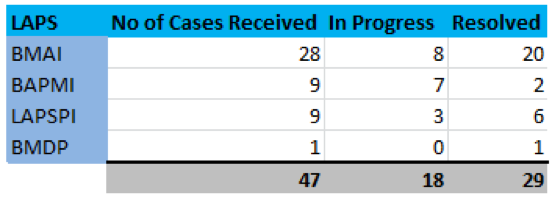

Concerning some unresolved complaints against PUJKs, the OJK encourages the public to forward them to alternative dispute resolution agencies (LAPSs), where consumers could go through mediation, adjudication, and even arbitration processes in order to resolve their complaints. Kusumaningtuti said that as of June 2016, these agencies reported to the OJK that they have received 47 requests from consumers who wanted to have their complaints resolved through their alternative mechanisms.

Based on the mandate stated in the law on the OJK to facilitate handling of complaints from financial consumers, the OJK has applied the following procedure:

1. Internal Dispute Resolution (IDR) mechanism. PUJKs are obliged to resolve their consumer complaints by providing functions or units that deal with the complaints, complete with competent human resources, SOPs, standard deadlines for resolutions and good communication systems. "Since the second half of 2016, the OJK together with the financial services industry have been preparing the IDR standard to be applied in banking, insurance and financing sectors."

2. When consumers fail to reach agreements with PUJKs over their complaints, they have another option called external dispute resolution (EDR) mechanism to resolve their disputes, by contacting one of the following institutions:

a) The Financial Services Authority (OJK)

The OJK receives complaints that result in immediate financial losses, however there is a maximum limit in regard to the amount of losses that it handles. The OJK set such limit in order to focus on small-scale financial consumers. It facilitates the mediation process by verifying the facts and seeking clarifications from both parties, either separately or by meeting both parties at the same time. Statistics showed that since it started its operation in 2013, the OJK has handled 3,832 complaints and resolved 93.72 percent of them.

b) Alternative Dispute Resolution Agencies (LAPSs)

For cases that cannot be resolved or for which no agreements are reached between financial consumers and PUJKs, consumers can contact alternative dispute resolution agencies (LAPS) that will lead them through mediation, adjudication and arbitration processes for their cases. The data below showed the cases that the agencies handled during the period of January 2016 to June 2016.

The following agencies have operated and been registered at the Financial Services Authority since January 2016: (1) the Indonesian Alternative Dispute Resolution Institution for the Banking Sector (LAPSPI); (2) the Indonesian Insurance Arbitration and Mediation Agency (BMAI); (3) the Indonesian Capital Market Arbitration Board (BAPMI); (4) the Indonesian Financing, Pawnshop and Venture Capital Mediation Agency (BMPPVI); (5) the Indonesian Arbitration and Mediation Agency for Underwriting Companies; (6) the Pension Fund Mediation Agency (BMDP).

Kusumaningtuti also added that the workshop, which invited experienced speakers such as Shane Tregillis—Chief of the Australian Financial Ombudsman Service, Sujatha Sekar Naik—CEO of the Securities Industry Dispute Resolution Center—from Malaysia and David Thomas—former Chairman of the British Financial Ombudsman, was expected to develop the agencies' skills in dealing with financial disputes.

"This workshop discusses and reviews various dispute cases in the financial sector, both in other countries and Indonesia. They are important lessons to learn, in order to develop trust of the public who will later use alternative dispute resolution agencies to handle their financial disputes," she said.

The financial services sector is expected to continuously improve the quality of their complaint handling procedure. So even when disputes are inevitable, their resolutions should satisfy public expectations, for example, by setting deadlines for the resolutions, upgrading the products/services that have caused the disputes and if necessary, amending the relevant regulations as well as improving the supervision carried out by the OJK.

***

For more information:

Anggar B. Nuraini

Deputy Commissioner for Consumer Education and Protection

Tel: 021 296 00000.

E-mail: b_nuraini@ojk.go.id. www.ojk.go.id